“Holding Title” is the way in which you take ownership of your Real Estate property. There are many different ways to take and hold title in California and it is best to be informed on all of them so that you as a buyer can make an informed decision that fits your needs best.

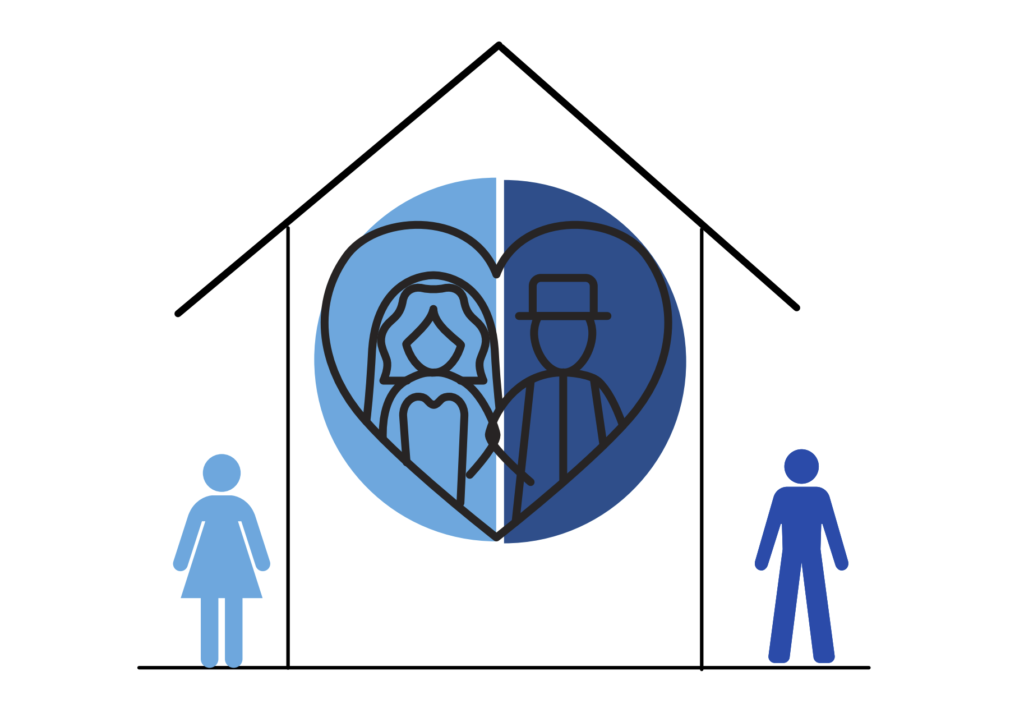

The graphic below outlines the different ways of “Holding Title” in the State of California.

Lets break this all down shall we?

How you take ownership of your real property will allow you to have a say in who has the legal authority to sign documents and obtain rights associated with the property. Some of these rights include: property taxes, income taxes, inheritability/gift taxes, and transferability of title.

Sole Ownership

This means that there is only one person on the deed of the property. When this person dies, this means that the property will go through a process called probate through the court to determine who will gain ownership of this property after the death of this individual or sole entity.

One way to avoid the process of probate would be through the Transfer on Death Deed. This is a way in California to assign ownership of your property to your heirs after your death.

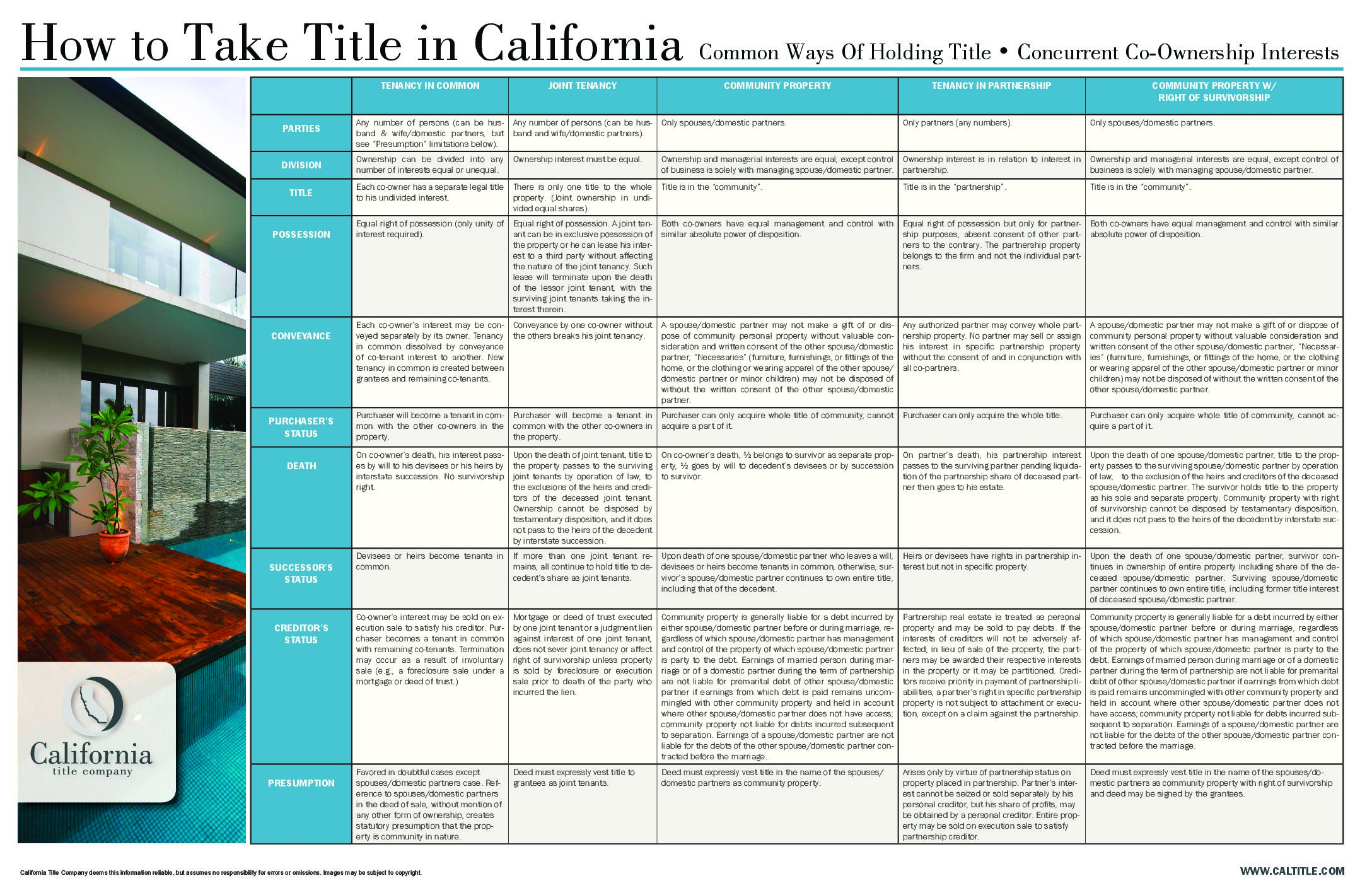

Joint Tenancy

This means that you and your co-owner(s) all have equal ownership of the property. This means that you own half, and your co-owner owns the other half equally.

Under this form of vesting, an owner is allowed to sell their portion of the property while alive, but is not allowed to will their stake of the property due to the Right Of Survivorship

The Right of Survivorship means that once you die the remaining co-owner(s) will assume your stake of ownership. This allows them to avoid the dreaded probate process.

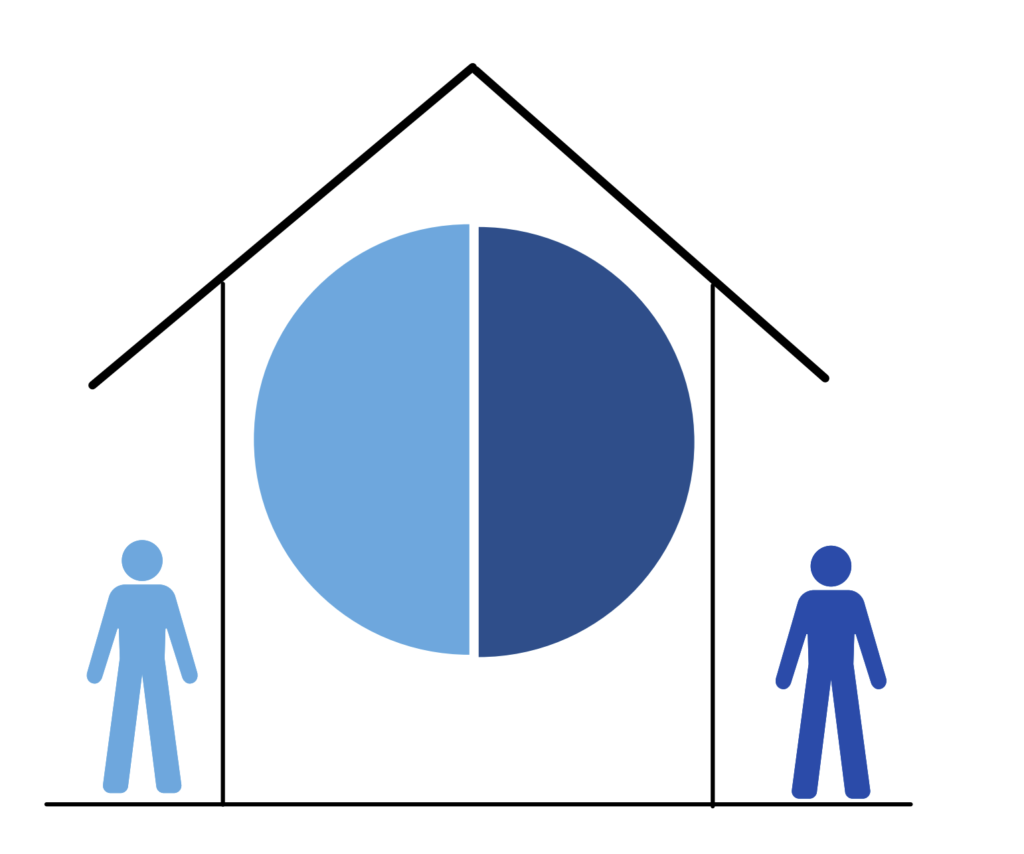

Tenancy in Common

This occurs when you have multiple co-owners with unequal ownership of the property.

When referencing the infographic to the right, Person Left (person on the left side) may own 75% of the property while Person Right owns 25% of the real property.

In this situation each owner has the ability to transfer, will or restrict their percentage of their ownership in the property.

You do not receive the Right of Survivorship with this form of vesting thus subjecting to probate.

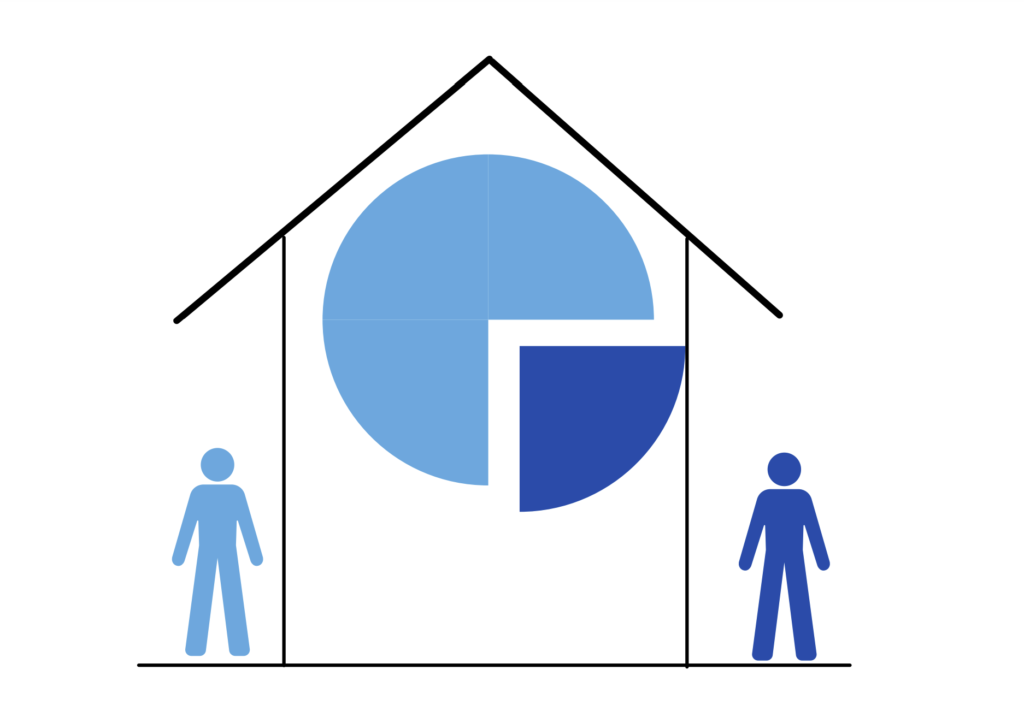

Community Property

Married couples only are subject to this form of vesting. When you get married, your spouse owns equal ownership unless otherwise stated in writing and signed by both parties.

What is unique about this form of vesting is that each spouse has the option to will their part of the ownership separately.

This form of vesting allows for the Right of Survivorship if stipulated. This means that the surviving spouse will own the property in its entirety.

Please consult your Real Estate Attorney for specific legal questions regarding this topic as we are not experts and do not practice law.

Shirin Rezania Ramos | 858.345.0685 | www.shirinramos.com | Compass, DRE 0203379