In 1978 Californians enacted Proposition 13, which limited many local public agencies’ ability to finance new projects. In 1982, Senator Henry Mello and Assemblyman Mike Roos affected the passage of the Community Facilities District Act (CFD).

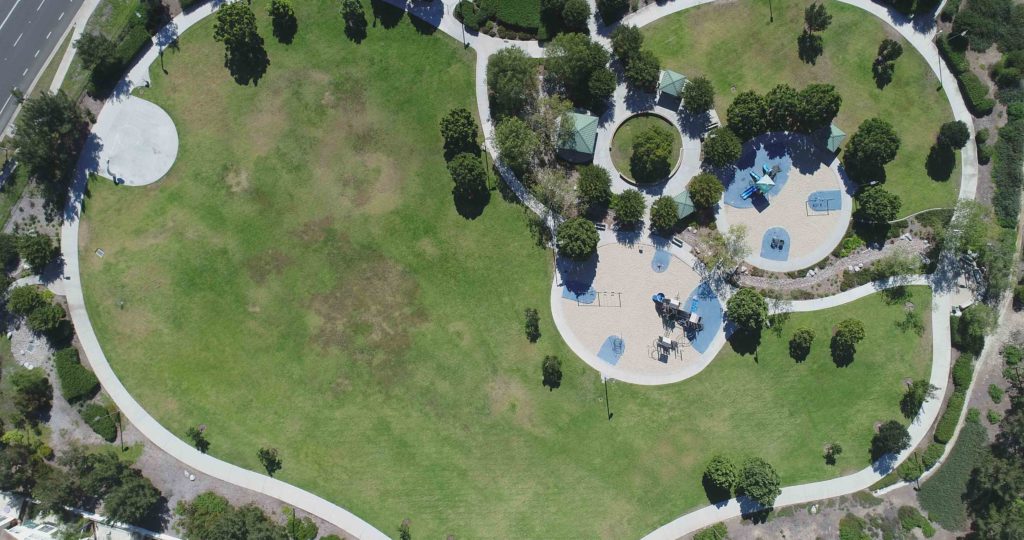

The CFD Act authorized local governments and developers to create CFD’s for the purpose of selling tax-exempt bonds to fund public services and facilities including streets, police protection, fire protection, ambulatory, elementary schools, parks, libraries, museums, and cultural facilities.

Homeowners within a CFD are responsible for an additional “special tax” (informally known as “the Mello-Roos“) to repay the bonds.

Mello-Roos is a form of financing that can be used by cities, counties, and special districts. Mello-Roos community facilities districts raise money through a special tax that must be approved by two-thirds of the voters within that district. A community facilities district is formed to finance major improvements and services within the district Which might include schools, roads, libraries, police and fire protection services, or ambulance services. The taxes are secured by a continuing lien and are levied against property within that specific district.

Mello-Roos districts are part of California’s mandatory property tax disclosure law. Failure to disclose the presence of a Mello-Roos district places the seller in jeopardy of non-disclosure litigation. Failure to give notice of a Mello-Roos bond prior to signing the sales contract gives the buyer a three-day right of rescission after receipt of the notice.

One key difference between a Mello-Roos fee and a “normal” property tax, is that Mello-Roos payments end when the corresponding bonds are paid off.

- School Districts are the most common beneficiaries of Mello-Roos fees.

- Mello-Roos is more common and often higher at newer subdivisions. Conversely, it is often lower or fully paid off on older homes.

Click here for more information on Mello Roos

Shirin Rezania Ramos | 858.345.0685 | www.shirinramos.com | Compass, DRE 0203379