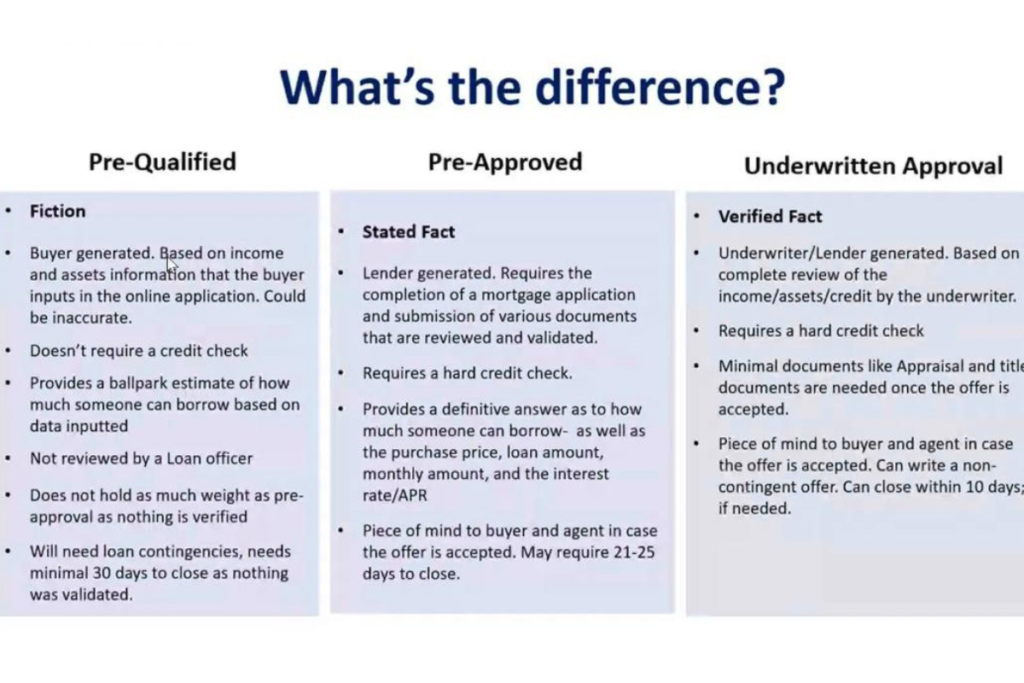

Pre-Qualified

- Fiction

- Buyer generated. Based on income and assets information that the buyer inputs in the online application. Could be inaccurate.

- Doesn’t require a credit check.

- Provides a ballpark estimate of how much someone can borrow based on data inputted.

- Not reviewed by a Loan officer.

- Does not hold as much weight as pre-approval as nothing is verified.

- Will need loan contingencies, needs minimal 30 days to close as nothing was validated.

Pre-Approved

- Stated Fact

- Lender generated. Requires the completion of a mortgage application and submission of various documents that are reviewed and validated.

- Requires a hard credit check.

- Provides a definitive answer as to how much someone can borrow- as well as the purchase price, loan amount, monthly amount, and the interest rate/APR

- Piece of mind to buyer and agent in case the offer is accepted. May require 21-25 days to close.

Underwritten Approval

- Verified Fact

- Underwriter/Lender generated. Based on a complete review of the income/assets/credit by the underwriter.

- Requires a hard credit check

- Minimal documents like Appraisal and title documents are needed once the offer is accepted.

- Piece of mind to buyer and agent in case the offer is accepted. Can write a non- contingent offer. Can close within 10 days; if needed.

What is your home worth? click here.

Homes for sale in Carmel Valley click here.

Shirin Rezania Ramos | 858.345.0685 | www.shirinramos.com | Compass, DRE 0203379