Deciding whether to rent or buy a home is a big decision. Renting might seem easier, but long-term, it has drawbacks. A Bank of America report shows 70% of prospective buyers worry about the future consequences of renting, like not building equity and facing rising rents.

Here’s a closer look at why buying a home in 2025 could be a smart financial move:

Build Long-Term Wealth:

• Homeownership allows you to transform monthly payments into an investment. As you pay off your mortgage and property values rise, your equity and net worth grow.

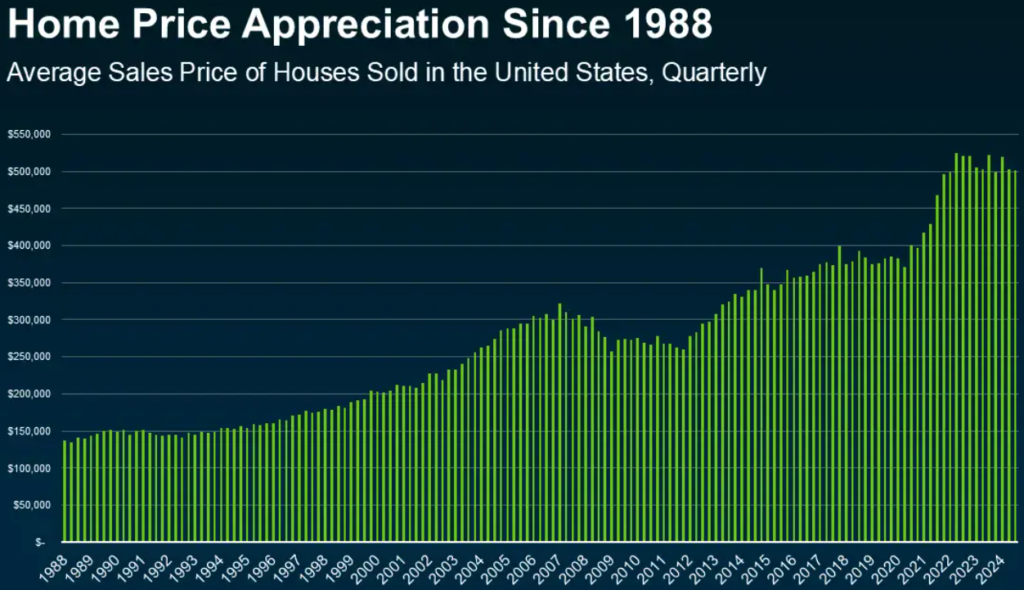

• Historical data from the Census and HUD show a general increase in home prices over time, reinforcing why 79% of buyers, per the National Association of Realtors (NAR), consider homeownership a wise financial investment.

Combat Rising Rental Costs:

• While renting might initially seem more affordable, rents have historically risen with time, increasing your financial obligations without providing any equity.

• Investing in a home can protect you from these rising rental costs and make it easier to plan for future financial goals.

Invest in Your Future:

• Every mortgage payment contributes to your future wealth, unlike rent which builds your landlord’s equity.

• If you’re financially capable of purchasing a home, doing so can offer long-term financial stability and growth.

Source: Census, HUD

If you’re considering taking the step towards homeownership in 2025, it can be a powerful way to secure your financial future. Curious about what homes are available in your area? Let’s connect and explore your options. Reach out to me at (858) 345-0685 to get started.

Homes for sale in Carmel Valley click here.

What is your home worth? click here.

Shirin Rezania Ramos | 858.345.0685 | www.shirinramos.com | Compass, DRE 0203379