Are you looking to purchase a new home but don’t have the funds for a down payment? The Cross Collateral loan program might be the solution for you. This innovative program, sourced from our in-house Compass Lender, Origin Point, allows buyers to secure a loan for their new home without the need for a down payment. Here’s a closer look at the benefits and qualifications of the Cross Collateral loan program from Origin Point:

Program Highlights:

• Borrow 100% of the purchase price plus closing costs

• Qualify on the final loan amount after the sale of the departing property

• Omit all debt on the departing property

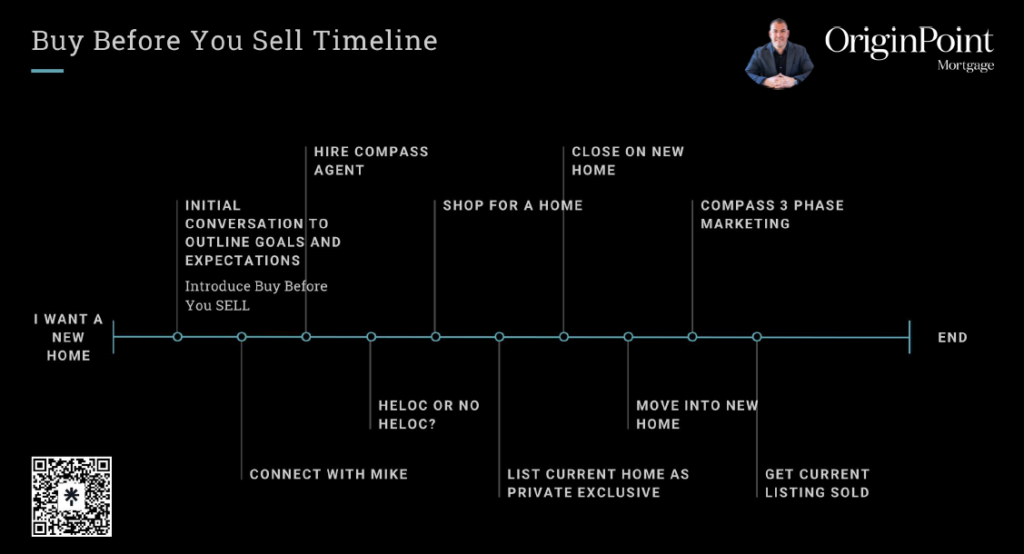

• Buy before you sell

• Make a non-contingent sale offer

• May combine with other programs like interest-only or asset depletion

Qualifications:

• Available in AZ, CA, ID, NV, NM, OR, TX, UT, and WA

• Specific California counties: Southern – Los Angeles, Orange, San Diego, Santa Barbara, and Ventura. Northern – Alameda, Contra Costa, Marin, Monterey, Napa, San Francisco, San Mateo, Santa Clara, Santa Cruz, and Sonoma

• The current residence may be listed for sale

• An appraisal and preliminary title report are required on both properties

• Properties must be in the same state

• The loan is qualified over 29 years

• .25% Rate Adjustment for Cross-Collateral

• REDUCE rate .25% when the departing property is sold Payments are re-amortized after the exit home is released, $250 re-amortization fee

• Can be combined with other programs like Asset Based Income and Interest Only

• 12 months principal, interest, taxes, and insurance reserves

With the Cross Collateral loan program, you can finance your new home purchase before your current one sells, and even take advantage of up to 100% financing options. If there’s enough equity in your current residence, this program allows you to make a non-contingent offer on a new residence without having to sell your current home first. It’s a great option for buyers looking to transition into a new home without the financial constraints of a traditional down payment.

Ready to sell? Know your home’s worth, click here.

Homes for sale in Carmel Valley click here.

Shirin Rezania Ramos | 858.345.0685 | www.shirinramos.com | Compass, DRE 0203379